Yinghe Technology's 2024 semi-annual financial report: Skol's revenue increased by 7.4% year-on-year to 1.539 billion yuan, accounting for 35% of total operating income

Leave a message

Yinghe Technology's 2024 semi-annual financial report: Skol's revenue increased by 7.4% year-on-year to 1.539 billion yuan, accounting for 35% of total operating income

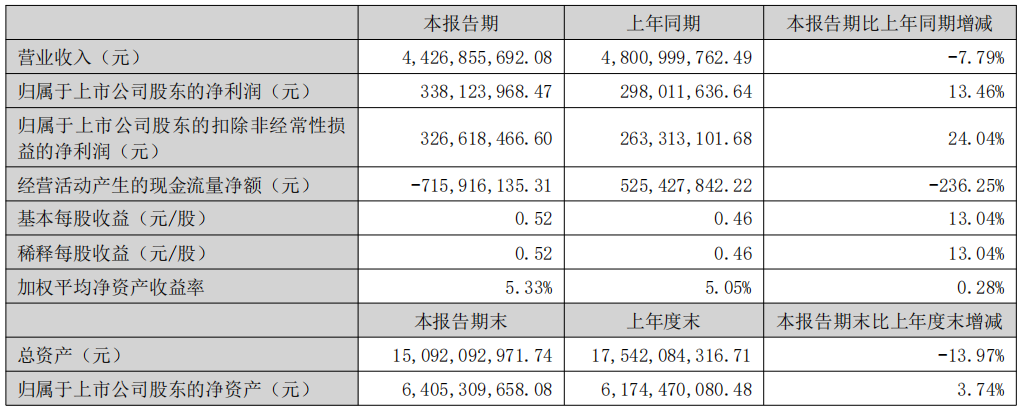

Yinghe Technology released its 2024 semi-annual report. In the first half of 2024, the company achieved operating income of 4.427 billion yuan, a year-on-year decrease of 7.79%; the net profit attributable to shareholders of listed companies was 338 million yuan, a year-on-year increase of 13.46%. Although overall revenue has declined, the company's profitability has been significantly improved, with the e-cigarette business becoming the biggest highlight.

On August 23, Shenzhen Yinghe Technology Co., Ltd. (hereinafter referred to as "Yinghe Technology", stock code: 300457) released its 2024 semi-annual financial report. Financial report data shows that the company achieved operating income of 4.427 billion yuan in the first half of 2024, a year-on-year decrease of 7.79%; the net profit attributable to shareholders of listed companies was 338 million yuan, a year-on-year increase of 13.46%. Although overall revenue has declined, the company's profitability has been significantly improved, with the e-cigarette business becoming the biggest highlight.

Operating income decreased by 7.79% year-on-year

In the first half of 2024, Yinghe Technology's operating income decreased by 7.79% from the same period of the previous year, from 4.801 billion yuan in the same period of 2023 to 4.427 billion yuan. The main reason for the decline in revenue is that the performance of the lithium battery special equipment business is not satisfactory.

The financial report shows that the revenue of this business has dropped from 3.259 billion yuan in the same period of 2023 to 2.677 billion yuan, a year-on-year decrease of 17.85%. However, thanks to effective cost control and refined management, the company's net profit has not decreased but increased, increasing by 13.46% year-on-year to 338 million yuan. This growth mainly comes from the control of administrative expenses and sales expenses, as well as the positive contribution of non-recurring profit and loss items.

The e-cigarette business increased by 7.4% year-on-year, accounting for 35% of the company's revenue

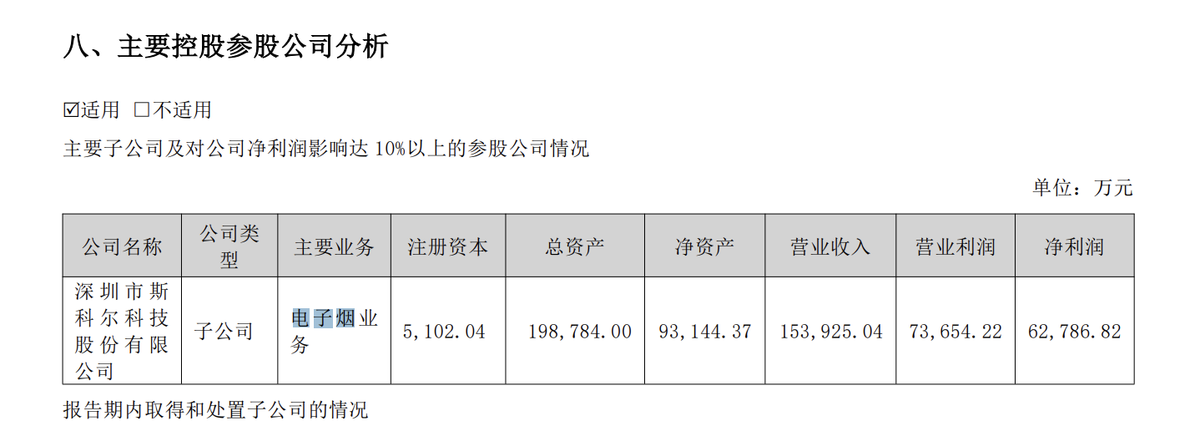

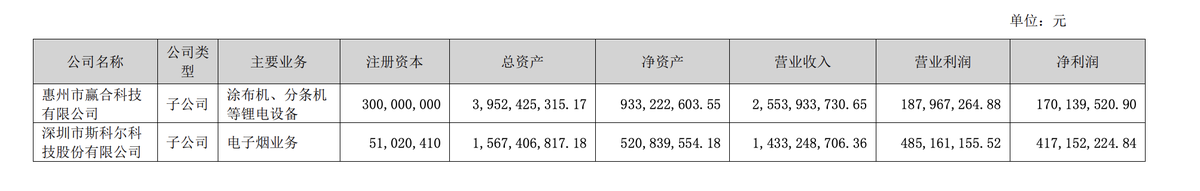

Yinghe Technology's e-cigarette business is operated by its holding subsidiary Shenzhen Skol Technology Co., Ltd. (hereinafter referred to as "Skoll"). Skol focuses on the research and development, production and sales of e-cigarettes and their accessories. Its main businesses include disposable e-cigarettes, cartridge-changing e-cigarettes and related accessories. Since Skoll stepped up its brand promotion efforts in 2022, its products have gained significant market share in the European market, especially in the UK and Germany, and obtained the European e-cigarette new product TPD certification.

Skoll 2024 first half report | Source: Yinghe Technology

Skol 2023 First Half Report | Source: Yinghe Technology

In the first half of 2024, Skol's e-cigarette business revenue reached 1.539 billion yuan, accounting for about 35% of the company's total operating income, an increase of 7.4% over the same period last year.

The report stated that Skol has gradually achieved the strategic goal of "based in the UK and radiating Europe" with its advantages in product technology and channel resources. During the reporting period, the company increased its efforts to develop the North American and Southeast Asian markets, and continued to expand sales areas and enhance brand awareness through advertising, social media interaction and ground promotion.

The report stated that Yinghe Technology plans to continue to increase investment in e-cigarette business and further expand overseas markets. The company plans to consolidate its leading position in the European market through continuous R&D innovation and product upgrades, and actively explore emerging markets such as North America and Southeast Asia.